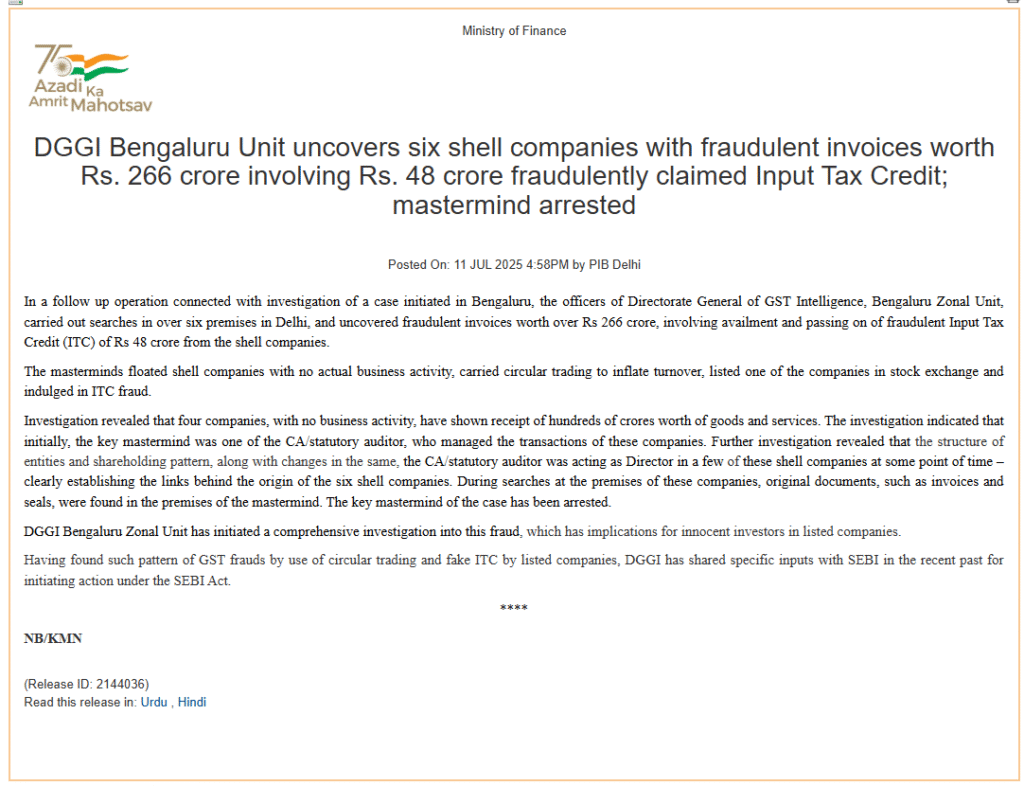

New Delhi: In a major crackdown on tax fraud, the Directorate General of GST Intelligence (DGGI), Bengaluru Zonal Unit, has unearthed a large-scale GST scam involving six shell companies based in Delhi. The investigation revealed fraudulent invoices worth over ₹266 crore and fake Input Tax Credit (ITC) claims amounting to ₹48 crore, the Ministry of Finance announced on Friday.

According to the ministry, DGGI officials conducted searches across more than six locations in Delhi, exposing a sophisticated network of fake billing and circular trading involving shell firms with no real business operations.

“The probe, which began in Bengaluru, showed that four of the firms had claimed receipt of goods and services worth hundreds of crores without any genuine business activity,” the official statement read.

The central figure behind the scam has been identified as a Chartered Accountant and statutory auditor who not only handled the transactions but also served as a director in some of these companies. The investigation uncovered original invoices, seals, and forged documents from the premises of the accused, who has since been arrested.

DGGI stated that the fraudulent ITC was being passed off through circular transactions designed to deceive tax authorities. Notably, some of the companies involved were linked to listed entities, raising red flags for investor security.

In light of these findings, DGGI has shared detailed inputs with the Securities and Exchange Board of India (SEBI) to initiate parallel action under the SEBI Act.

Officials said a wider probe is underway to uncover more layers of the scam, including potential involvement of other professionals and financial entities.